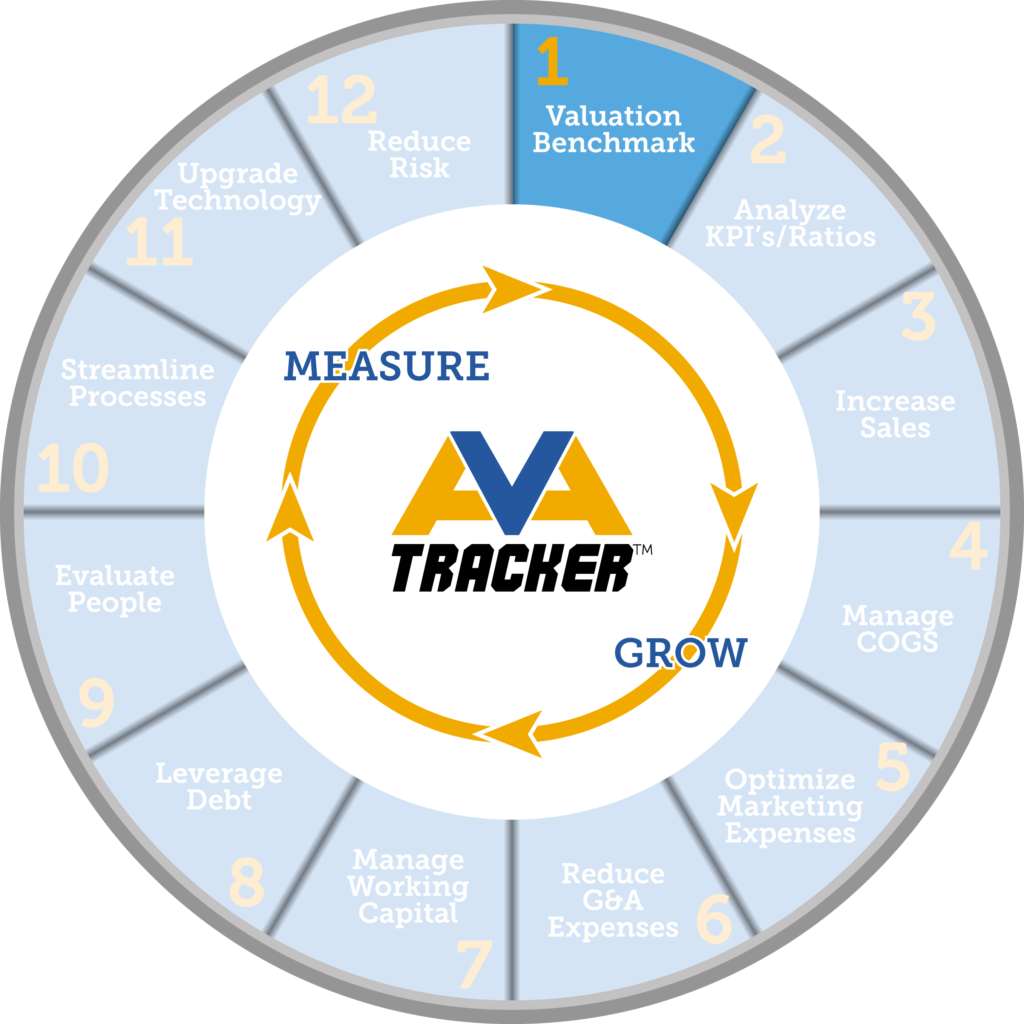

The first in a series on Tracker™

Tracker™ is a unique process developed to answer two questions that I often hear from business owners:

- What is the value of my business?

- How do I increase the value of my business?

In the next few articles, I am going to discuss how to answer the first question, “What is the value of my business?”

There are three approaches to valuing a business. There are various valuation methods under each approach, but I won’t go into those here. Since this blog is meant to be more practical than technical, I will describe each approach at a high level:

- Income approach

- Market approach

- Asset approach

The Income approach is a general way of determining the value of a business using one or more methods to convert future cash flows into a present value at the date of valuation. The process includes gathering financial information, making projections of how the business is expected to perform, then discounting the cash flows back to the date of the valuation. Several factors are considered such as:

- How much will revenue increase over the next few years?

- How much will expenses increase during the same time period?

- Do any adjustments need to be made to income or expenses to normalize earnings?

- What effect will this growth rate have on working capital, capital expenditures, and debt?

- What discount rate will be used to calculate the present value of this income stream?

- Once a present value of benefits is determined, should any discounts be taken for lack of marketability or lack of control?

The Market approach is a general way of determining the value of a business by using one or more methods to compare the business being valued with other similar businesses that have already sold. The process includes accessing various data bases, including both public and private companies, containing information on the sale of businesses. It is important to find an example of a business as similar as possible to the business being valued for a meaningful comparison.

The Asset approach is a general way of determining the value of a business using one or more methods based on the value of assets net of liabilities. Sometimes, one needs to consider intangible assets as well as tangible assets.

The next question which I hear often is, “So which one do you use?” As you might expect, the answer is “it depends.” Each business valuation is separate and unique from the next. Factors such as Standard of Value, valuation date, and purpose of the valuation are taken into consideration. One approach for valuing one business may not be as applicable to the valuation of another business.

For example, I recently worked on two separate valuations. In the first example, ABC Company had only been in business for a short time and sold its product 100% online. There were no fixed assets (no land, building, or equipment). There were no employees, just independent contractors. This was strictly a cash-in, cash-out business. No accounts receivable, inventory, or accounts payable. After all expenses were paid, the partners split the net proceeds leaving a small amount of cash in the business. In this scenario, the Income approach was more applicable. The Asset approach would not make sense in this case. And it just so happened that there were no market comparables.

In the second example, XYZ Company. Changes in the industry created downward pressure on pricing, thus squeezing profit margins. However, since the company had been in business several years, it had accumulated a significant amount of land, buildings, and equipment. Although I evaluated both the Income and Asset approaches, I felt like the Asset approach was best.

Which approach is best for your business – Income, Market or Asset — depends on your unique situation. In some cases, more than one approach or all three approaches are used. Just as every business is unique, every valuation is customized for that entity.

If you have any questions about measuring and growing the value of your business, please contact me for a free conversation.